Introduction

Navigating the complexities of business sale negotiation strategies in the UK can be a daunting task. With the UK business marketplace experiencing steady growth, as evidenced by a 2025 report from the Office for National Statistics indicating a 5% increase in business sales year-on-year, understanding the nuances of negotiation is crucial. This guide will provide a comprehensive framework to help business sellers optimise their strategies and ensure successful transactions.

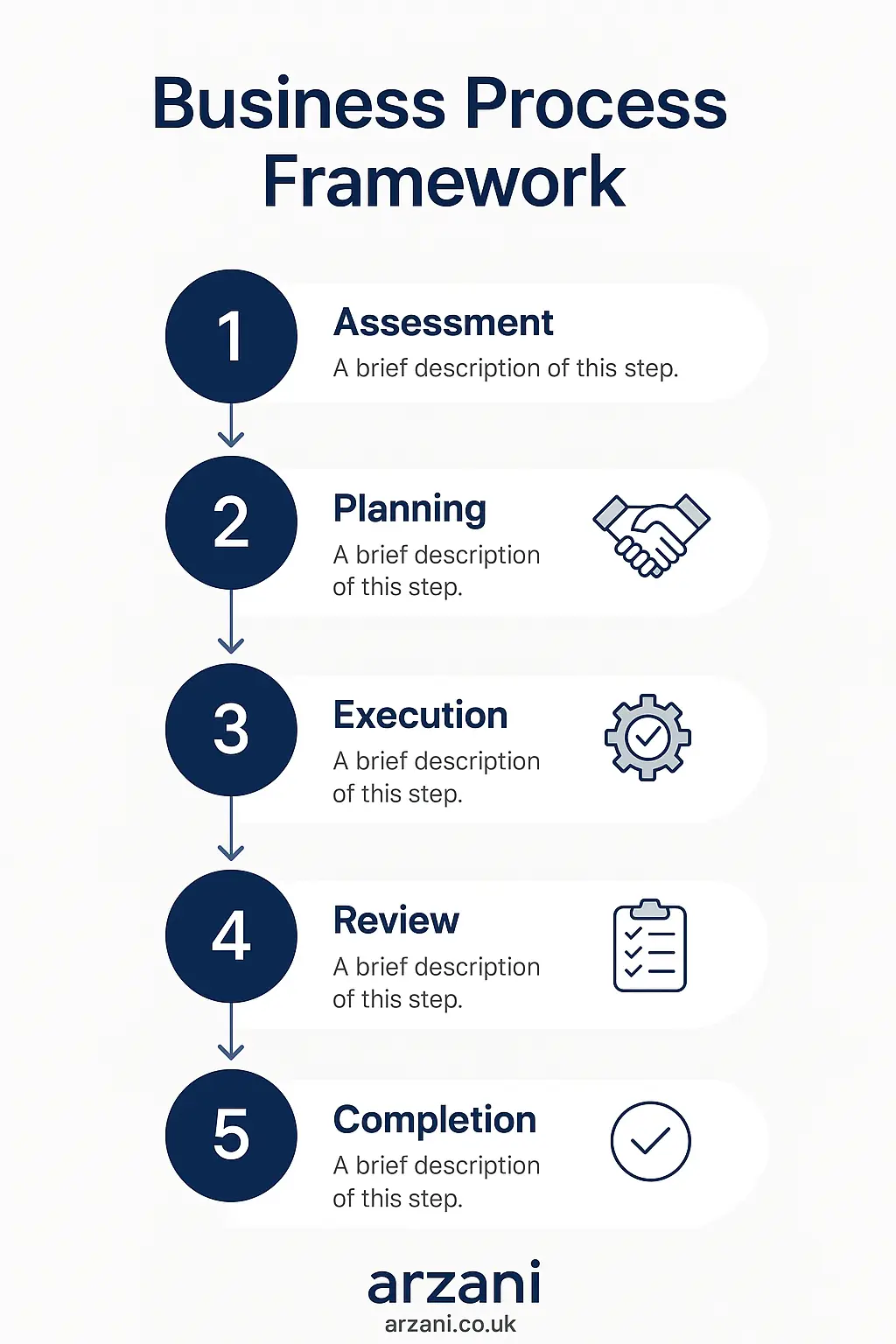

Business Process Framework - Step-by-step business business sale negotiation strategies uk process framework infographic

Table of Contents

1. Preparing Your Business for Sale

The first step in the business sale process is thorough preparation. Sellers should conduct an in-depth analysis of their business to ensure it is attractive to potential buyers. According to Companies House, having up-to-date financials and clear operational structures is essential. Consider investing in professional audits to present a clean financial slate.

2. Understanding Buyer Profiles

Identifying potential buyers and understanding their motivations can significantly impact the negotiation process. In the UK, buyers may range from private equity firms to individual entrepreneurs. Tailor your communication and negotiation strategies to match the buyer's profile, ensuring alignment of interests.

3. Valuation and Pricing Strategies

Accurate valuation is critical in setting a competitive price. Employ methods such as discounted cash flow analysis or comparable company analysis to determine a fair market value. ONS data indicates that businesses in the tech industry can command higher multiples, reflecting their growth potential.

UK Market Statistics - UK business sale negotiation strategies uk market statistics and data visualization

4. Negotiation Tactics

Effective negotiation tactics can make or break a deal. In our experience facilitating over £50 million in business transactions, we recommend the following strategies:

- BATNA Analysis: Know your Best Alternative to a Negotiated Agreement to strengthen your position.

- Emotional Intelligence: Understand and manage both your and the buyer's emotions during negotiations.

- Terms Flexibility: Be open to adjusting terms rather than strict pricing to meet buyer needs.

5. Legal and Regulatory Considerations

Adhering to legal and regulatory frameworks is critical. Ensure compliance with all relevant laws, including the FCA regulations if your business operates in the financial sector. Engaging legal professionals can provide guidance on contractual obligations and protect against liabilities.

6. Closing the Deal

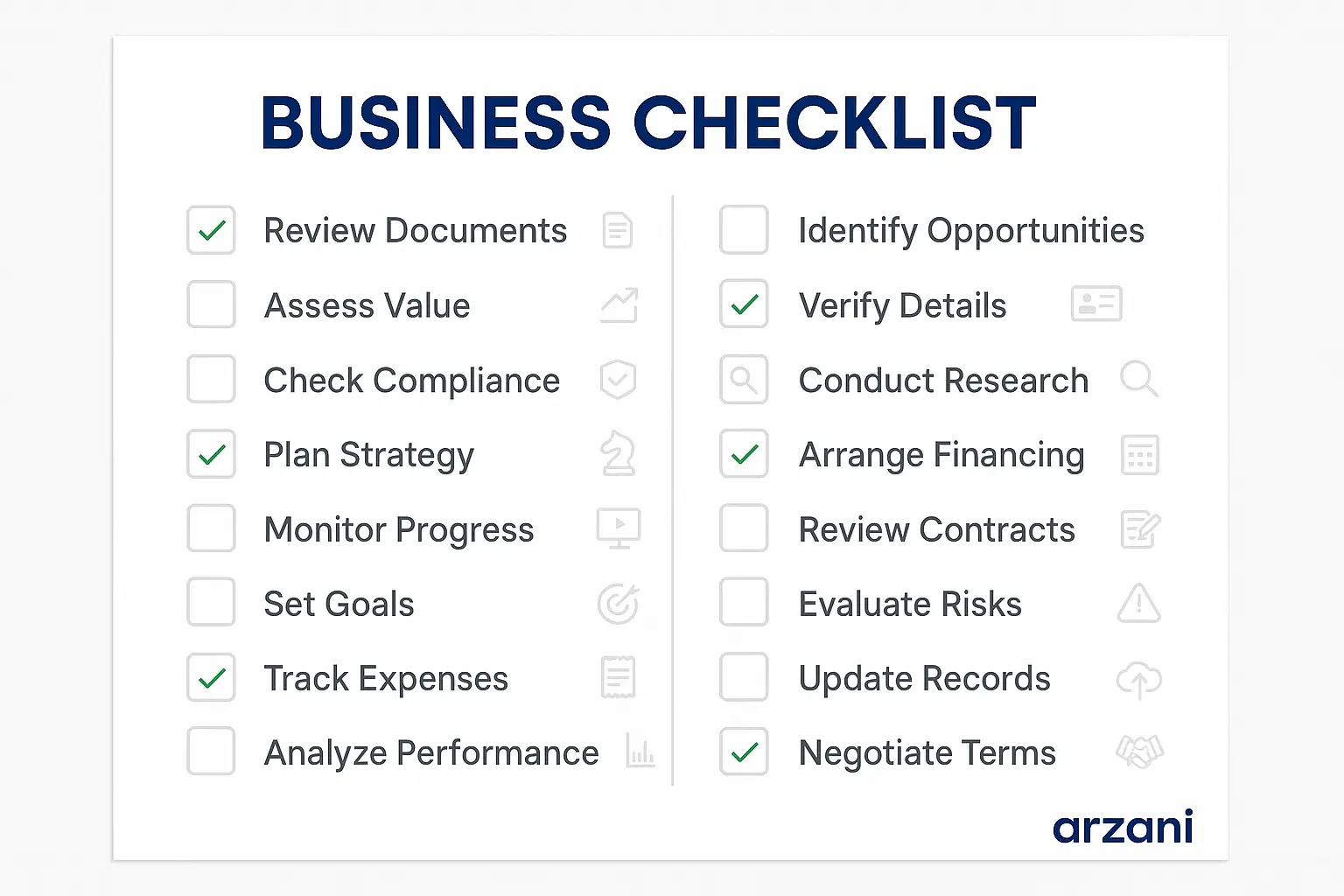

Finalising the deal involves thorough due diligence and agreement on terms. Both parties should agree on a timeline for the transition. Additionally, an escrow arrangement may be beneficial to manage any post-sale adjustments.

7. Post-Sale Transition

Ensuring a smooth transition post-sale is vital for maintaining business continuity. This phase often includes transferring knowledge, client relationships. Additionally, operational systems to the new owner. A well-structured transition plan can mitigate disruptions.

Case Studies

Consider the sale of a mid-sized manufacturing firm in Leeds. This was valued at £1.8 million. The use of a strategic negotiation framework allowed the seller to increase the initial offer by 15%. Another example includes a tech startup in London sold for £2.5 million, where the inclusion of earn-out clauses ensured alignment of interests post-sale.

Business Timeline - Typical business sale negotiation strategies uk timeline and milestones infographic

Frequently Asked Questions

What is a typical multiple for UK SMEs?

Multiples vary by industry, but SMEs often see a range from 3x to 5x EBITDA, according to recent market analyses.

How long does the business sale process take?

On average, the process takes 6 to 12 months, depending on business size and industry.

What documents are needed for a business sale?

Key documents include financial statements, tax returns, asset lists, and legal agreements. Consult with a legal advisor for a comprehensive checklist.

How can I maximise the sale price?

Enhance business value through operational improvements and robust financial systems to attract higher offers.

What role does due diligence play?

Due diligence ensures that the buyer verifies the business's financial health and operational integrity before finalising the purchase.

Business Checklist - business sale negotiation strategies uk checklist and key considerations infographic

Conclusion

Successfully navigating the complexities of business sale negotiation strategies in the UK demands careful planning and execution. By following this structured approach, sellers can enhance their negotiation outcomes, ensuring they achieve the best possible terms. For further support, visit Arzani.co.uk for expert guidance and marketplace insights. Explore our resources and connect with our team to optimise your business sale strategy today.

About Sarah Mitchell, Business Valuation Expert

Chartered Business Valuator with 15+ years experience in UK SME valuations. Previously Senior Analyst at Deloitte Corporate Finance, now leads business assessment initiatives at Arzani. Holds RICS qualification and has valued over £500M in UK business transactions. Connect on LinkedIn: /in/sarah-mitchell-cbv